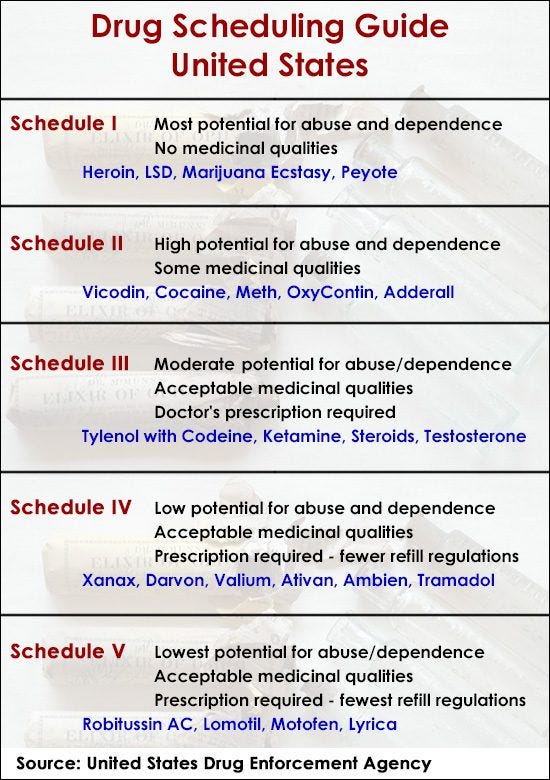

Above is a picture of how the DEA currently classifies drugs, with weed being in the same schedule as Heroin, LSD, and others

If cannabis gets moved from Schedule I to Schedule III, the biggest win is the end of IRS 280E tax restrictions 💸. Right now, weed companies can’t deduct normal expenses like rent, payroll, or marketing — they’re taxed on gross income, leading to sky-high tax rates. Rescheduling would fix that overnight, freeing up millions in cash flow.

Next up? Easier banking 💳, lower financing costs, and more investment flowing into the industry 📈. Stocks could rally fast, especially for companies already operating in multiple states.

In short: less tax, more cash, bigger market.

🌿 Cannabis Stock Watchlist (U.S.-Listed)

💰 Large-Cap (Market Cap > $1B)

Curaleaf Holdings (CURLF) – Largest U.S. cannabis operator by revenue.

Green Thumb Industries (GTBIF) – Multi-state operator with strong retail presence.

Verano Holdings (VRNOF) – Vertically integrated, premium cannabis brand.

Trulieve Cannabis (TCNNF) – Florida powerhouse expanding nationwide.

Tilray Brands (TLRY) – Canadian-based, with cannabis and beverage portfolio.

Cronos Group (CRON) – Canadian producer with U.S. investments.

🌱 Mid-Cap (Market Cap ~$500M–1B)

Cresco Labs (CRLBF) – Major wholesaler and retailer across multiple states.

Glass House Brands (GLASF) – California-based greenhouse cultivator.

Sundial Growers (SNDL) – Cannabis and liquor business hybrid.

🍀 Small/Micro-Cap (Below $500M)

Canopy Growth (CGC) – Canadian cannabis with U.S. exposure.

Aurora Cannabis (ACB) – Canadian producer trading on U.S. exchanges.

Village Farms International (VFF) – Produce grower turned cannabis cultivator.

TerrAscend (TSNDF) – Multi-state operator with premium products.

Columbia Care (CCHWF) – Multi-state operator (merging into Cresco Labs).

Flora Growth (FLGC) – International cannabis cultivator and brand.

Cannabis ETFs

If you don’t want to pick individual cannabis stocks, you can buy an ETF that holds a basket of them. Here are some of the most notable ones on U.S. exchanges:

AdvisorShares Pure US Cannabis ETF (MSOS) – The largest U.S.-focused cannabis ETF, holding many of the biggest multi-state operators.

ETFMG Alternative Harvest ETF (MJ) – One of the first marijuana ETFs, with a mix of U.S. and international cannabis companies.

Amplify Seymour Cannabis ETF (CNBS) – Actively managed, focusing on companies earning a majority of revenue from cannabis.

Cambria Cannabis ETF (TOKE) – Global cannabis exposure with an active management style.

Global X Cannabis ETF (POTX) – Tracks the Cannabis Index, with companies in cultivation, production, and distribution.

Risk’s Involved

Regulatory Risk

Cannabis remains illegal at the federal level in the U.S., leading to ongoing legal uncertainty. Changes in policy, enforcement, or delays in rescheduling can greatly affect the industry.Banking and Financial Services Restrictions

Many cannabis companies have limited access to banking services and traditional financing due to federal laws, which can impact operations and growth.Market Volatility

Cannabis stocks are known for high volatility and can be impacted by speculative trading, changing consumer sentiment, and fluctuating market conditions.Competitive and Fragmented Industry

The cannabis market is highly competitive with many small players, varying state regulations, and rapidly changing market dynamics.Operational Risks

Challenges include supply chain issues, quality control, and the complexities of managing cultivation, distribution, and retail in a highly regulated environment.Valuation and Profitability Concerns

Many cannabis companies operate at a loss and have uncertain paths to profitability, which can affect investor returns.Reputational and Social Risks

Shifts in public opinion, social stigma, or political opposition can impact companies and their market opportunities.

Works Cited

Trump Could Ease Marijuana’s Federal Classification. That Sent Pot Stocks Flying. Investopedia. August 11, 2025.

https://www.investopedia.com/trump-could-ease-marijuana-s-federal-classification-that-sent-pot-stocks-flying-11788864Trump “Looking at Reclassification” of Marijuana as Less Dangerous Drug. Axios. August 11, 2025.

https://www.axios.com/2025/08/11/trump-marijuana-reclassification-federal-dangerous-drugsTrump Says He’ll Make a Decision on Reclassifying Marijuana in the Coming Weeks. Politico. August 11, 2025.

https://www.politico.com/news/2025/08/11/trump-marijuana-reclassification-decision-00503684How Would Rescheduling Marijuana Affect Cannabis Banking? Green Check Verified. 2024.

https://greencheckverified.com/how-would-rescheduling-marijuana-affect-cannabis-banking

📢 Disclaimer:

I am an Investment Advisor Representative for Fenwick Financial, a registered investment advisory firm.

This post is intended for informational and educational purposes only and should not be considered personalized investment advice or a recommendation to buy or sell any security.

All investments carry risk, and past performance is not indicative of future results. The opinions expressed here are my own and do not necessarily reflect those of any firm or institution.

Disclosure: I am personally trading some of the companies mentioned in this post. That does not mean these investments or trades are right for you. Always do your own research or speak with a financial professional before making any decisions. Fenwick Financial does not day-trade client funds and has nothing to do with Luke Fenwick’s own day-trading account and information posted.

The SEC and state regulators do not approve or disapprove of this message.